A Gift in Your Will or Trust

With as little as one sentence, you can make a gift in your will or trust that significantly impacts the efforts of GLIDE. Whether you choose to give a set amount or a percentage of your estate, your support ensures we are able to continue our work for years to come.

Use Your IRA

If you are 70½ years old or older, you can take advantage of a simple way to give to GLIDE and receive tax benefits in return. You can give up to $100,000 from your IRA directly to a qualified charity without having to pay income taxes on the money.

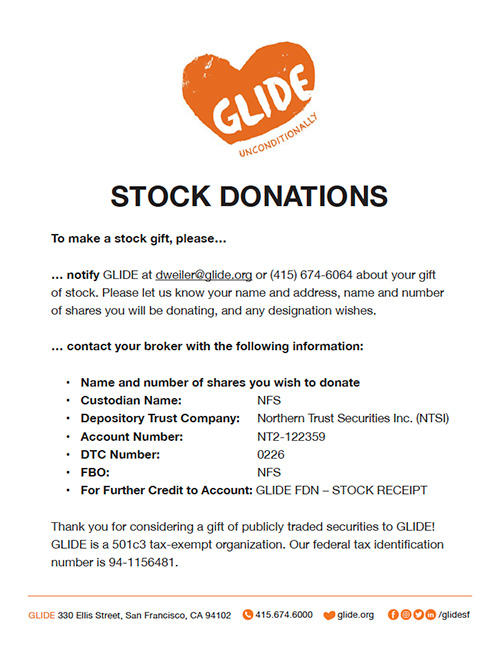

Gifts of Stock or Mutual Funds

If you’re looking for a tax-smart way to create inclusive, just and loving communities, consider a gift of stock. When you give appreciated stock or mutual funds that you’ve owned for more than one year, you can avoid capital gains tax and receive a charitable income tax deduction when you itemize.

Thank You!

Please use the link below to download the Stock Transfer Instructions. Contact Planned Giving at 415-674-6186 or legacygiving@GLIDE.org with questions.

Retirement Plan Assets

Retirement plan assets are a great way to support the work at GLIDE because they not only help support our mission, but they also can provide tax relief for your loved ones. Consider leaving your loved ones less heavily taxed assets and leaving your retirement plan assets to GLIDE.